Personal Finance Management Tips: Save Smart, Spend Smarter

Introduction

Personal finance management is one of the most important life skills every individual should develop. Whether you’re a student, a professional, or nearing retirement, understanding how to manage your finances can help you avoid debt, build savings, and achieve financial freedom. In this complete guide, we’ll walk you through effective budgeting, saving, investing, and money management strategies.

Why Personal Finance Management Matters

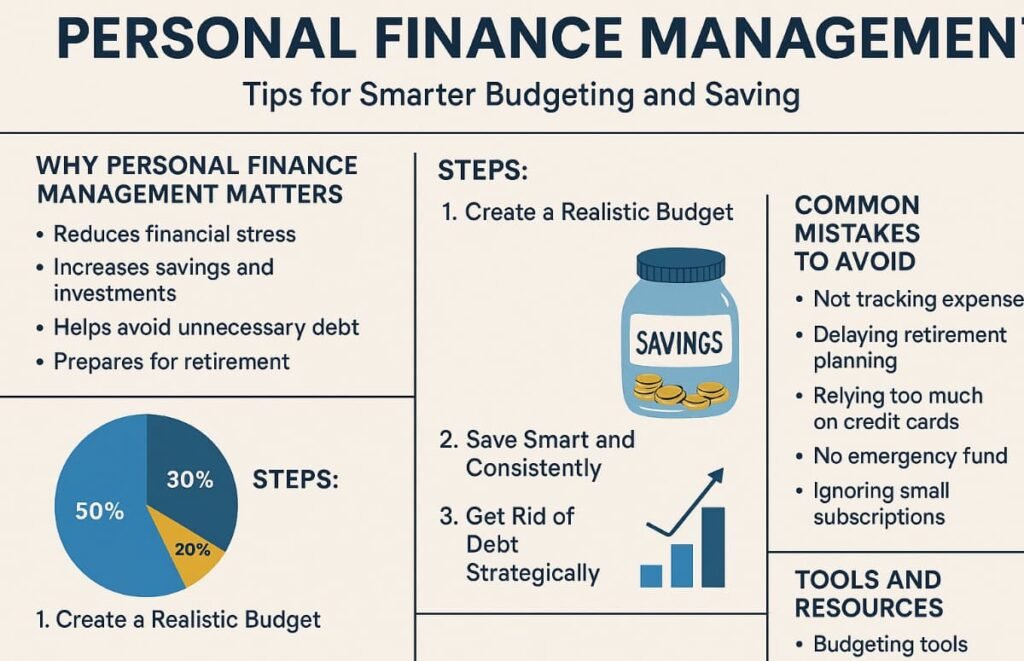

Without proper financial planning, many people struggle to cover their basic needs, fall into debt, or miss out on investment opportunities. Personal finance management gives you the control and visibility to make informed decisions. It helps you plan for emergencies, set financial goals, and stay on track.

Key Benefits:

Reduces financial stress

Increases savings and investments

Helps avoid unnecessary debt

Prepares you for retirement

Enables goal-based financial planning

Step 1: Create a Realistic Budget

A budget is a plan for your income and expenses. Without a budget, money often gets spent impulsively. Tools like Mint or You Need A Budget (YNAB) help you track spending in real time.

Budgeting Tips:

Calculate your net income

Categorize your expenses (fixed, variable, emergency)

Follow the 50/30/20 rule (needs/wants/savings)

Review and adjust monthly

Step 2: Save Smartly and Consistently

Savings are the backbone of financial security. They help you handle medical emergencies, job losses, and other unexpected events. Automating your savings ensures consistency.

Types of Savings:

Emergency Fund (3–6 months of expenses)

Short-term Goals (vacation, new gadget)

Long-term Goals (home, education, retirement)

Pro Tip: Use high-yield savings accounts to earn better interest.

Step 3: Get Rid of Debt Strategically

Debt is often the biggest obstacle to financial growth. Make a list of all your debts and tackle them using methods like:

Debt Snowball: Pay off the smallest debt first

Debt Avalanche: Pay off the highest interest rate first

Negotiate lower interest rates or consolidate loans

Step 4: Learn the Basics of Investing

Once you’ve saved and reduced your debt, it’s time to grow your money. Investing is an essential part of personal finance management. It helps you beat inflation and build wealth.

Investment Options:

Stocks & ETFs

Mutual Funds

Real Estate

Retirement Accounts (e.g., 401(k), IRA)

Step 5: Track, Analyze & Improve

Review your financial progress monthly. Are you meeting your savings targets? Is your spending aligned with your budget? Use spreadsheets or apps like PocketGuard to analyze and improve your financial habits.

Common Mistakes in Personal Finance Management

Avoid these pitfalls:

Not tracking daily expenses

Delaying retirement planning

Relying too much on credit cards

No emergency fund

Ignoring small subscriptions that add up

Tools and Resources You Can Use

Budgeting Tools: Mint, YNAB

Saving Apps: Digit, Chime

Investment Platforms: Robinhood, Vanguard, Fidelity

Financial Education: NerdWallet, Khan Academy Finance

Conclusion

Effective personal finance management doesn’t require a finance degree it only takes consistency, planning, and commitment. Whether you’re saving for a trip or planning for retirement, start small and stay focused. Your financial independence journey begins today.

One Comment