How to Create a Student Monthly Budget Plan in 5 Easy Steps

Student Monthly Budget Plan: Beginner-Friendly Monthly Budget Guide for Students

A Student Monthly Budget Plan is a financial plan that helps students maintain a healthy balance between their income and monthly expenses. In simple terms, a budget is a proper account of how much money is coming to you and where it is being spent. It helps students reduce unnecessary expenses, save money, and stay free from the burden of debt.

Lack of money often arises in student life. Saving money to manage tuition fees, mess rent, food and drinks, and other expenses can sometimes be difficult. However, with a proper plan or budget, it is possible to get through the month even with little money. In this article, we will discuss in detail the rules for creating a budget plan, money-saving strategies, and popular methods like 50/30/20.

Why is it important for students to create a budget?

Learning financial discipline is very important in student life. Creating a budget allows you to have full control over your money. Some of its main benefits are discussed below:

- Reduces unnecessary expenses: With a budget, you will understand which expenses are essential and which are luxuries.

- Stay debt-free: There is no need to borrow from friends at the end of the month.

- Future savings: The habit of saving money little by little is developed during student life.

- Peace of mind: It is easier to focus on studies because you do not have to worry about money.

Summary: A budget is not just a money account; it helps you to be financially independent and worry-free.

More: Personal Finance Management Tips.

5 Smart Steps for a Practical Student Monthly Budget Plan

Creating an effective budget is not difficult. You can easily create your monthly budget plan by following the steps below.

1. Calculate Your Total Income

The first step in creating a budget is to find out your sources of income. These may include:

- Handouts from family.

- Tuition or part-time job salary.

- Scholarship or bursary money.

Write down the total amount of money you receive each month in a notebook or Excel.

2. Categorize Expenses

- Your expenses should be divided into two main categories:

- Fixed Expenses: Which remain the same every month. For example: mess rent, internet bill, and tuition fees.

Variable Expenses: Which may vary from month to month. For example: food expenses, transportation fare, and entertainment.

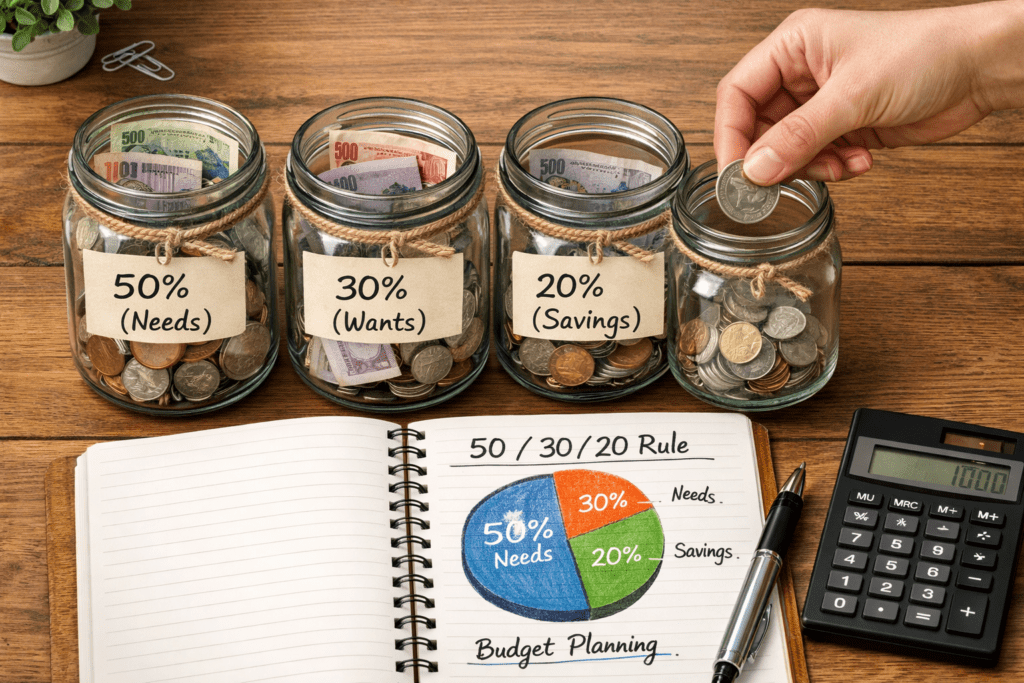

3. Follow the 50/30/20 Rule

This rule, popular all over the world, is the most effective for creating a monthly budget for students. It is shown in the table below:

| Category | Percentage of Income | Example (for income of 5000 taka) |

| Needs | 50% | “2500 taka (rent, food, transportation)” |

| Wants | 30% | “1500 taka (movie, outing, data pack)” |

| Savings | 20% | “1000 taka (emergency, fund for the future)” |

4. Track Your Spending

After making a budget, the real work is to stick to it. Write down your daily expenses in a notebook or mobile. Compare them at the end of the month to see if you are within the budget.

5. Regular review and adjustment

Not all months’ expenses are the same. The cost of buying books may increase during exams, and the cost of shopping during Eid. So, review your budget plan once at the beginning of each month.

Summary: If you spend according to your income and follow the 50/30/20 rule, creating a budget and following it becomes much easier.

Some of the best ways to save money (Money Saving Tips)

In addition to creating a budget, saving is easier if you know the strategies to reduce expenses. Here are some tips on how to save money:

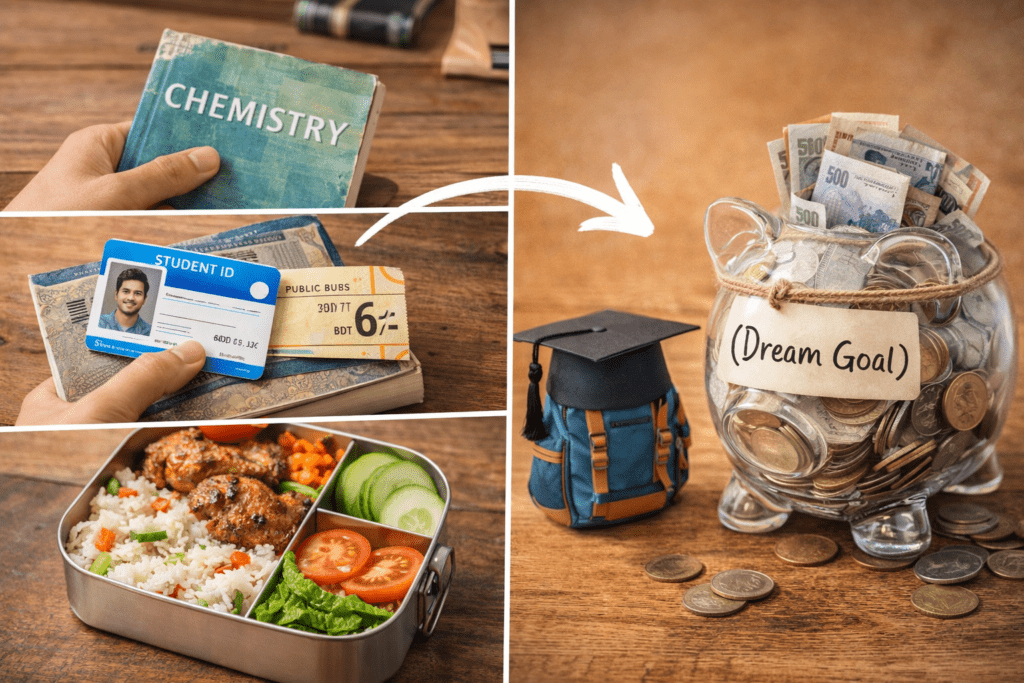

- Buy old books: Get new semester books from the library or buy them from seniors at a lower price.

- Cook and eat: It is much cheaper and healthier to eat at a mess or home-cooked meals than eating out.

- Use student discounts: Get discounts on buses, museums, or when buying software by using your student ID card.

- Use public transportation: Take the bus or rideshare instead of rickshaws or ridesharing. This will save you a lot of money each month.

Best Tools for Budget Tracking

Many people find keeping track of their money in pen and paper a hassle. In that case, you can use digital tools:

- Google Sheets / Excel: Best for creating custom budget sheets.

- Mobile Apps: ‘Wallet,’ ‘Monefy,’ or ‘Money Manager’ apps are very popular.

- Envelope Method: Those who have to use cash more can keep money aside in different envelopes (e.g., rent, food).

Conclusion

Following the rules of creating a monthly budget plan for students may seem difficult at first. But once it becomes a habit, it will make your life much more organized. Sit down with a pen and paper or Excel sheet today and create your budget for the next month. Remember, today’s small savings will help you fulfill your big dreams tomorrow.

FAQ

A: You should try to save at least 20% of your income. If that is not possible, start with 500 or 1000 taka. The main goal is to develop a habit of saving.

A: To avoid such a situation, keep a “Miscellaneous” category in your budget. Also, you can take money from the emergency fund, but make it up next month.

A: This is a general guideline. Sometimes it can be difficult to meet your needs with 50% taka as a student. In that case, you can adjust it to 60/20/20 or 70/20/10.

A: Don’t get discouraged. Analyze why your budget failed. Maybe you set an unrealistic target. Correct it next month and start anew.

A: Save money for a specific goal (like buying a laptop or going on a trip). It’s easier to stick to a budget if you have a goal.